Impact investing is starting to gain traction in Africa. The global impact investing market is estimated at $502 billion and the African continent represents a market full of opportunity for investors.

The aim of impact investing is to put money into companies that generate a measurable and beneficial social or environmental impact alongside a financial return.

African governments can not be expected in to address the myriad social and economic challenges the continent faces alone. Indeed, in countries like South Africa it is the private sector which has held the country steady during long years of political crisis and corruption. The private sector increasingly takes the place of government in providing solutions in areas from education to support for SMEs.

However, many feel that just as it has been demonstrated that government should stay out of business, it is foolish for investors to focus on anything other than generating profits for their clients. Generating financial returns from social and environmental projects can be difficult and come with a high degree of risk. The private sector does not like risk, and does not like losing money.

However, there is a well-established track record of success in the impact investing market. In fact, many investors are more frustrated at the lack of impact investment projects available in Africa at present.

Is the market really demanding an ethics first approach to investment now? And what does the long term future look like for impact investing on the African continent?

_________________________________________________________________________

“I think there’s always been impact investing, maybe it’s become a bit more fashionable as interest rates in other territories drop so we’re seen as a better destination.

“I think there’s always been impact investing, maybe it’s become a bit more fashionable as interest rates in other territories drop so we’re seen as a better destination.

There is a significant role for impact finance. In terms of our business, we’re very focused on financial inclusion and we’ve also been able to develop products that fit within the regulatory framework without exposing us to the traditional exposure. I think there’s a huge opportunity for business at large but also large investors to invest in those specific channels and develop them in South Africa.

The key to it though is if you don’t manage that properly, you’ll lose your money so your impact becomes risk finance entirely and you lose the opportunity to replicate that over and over. But we do see a significant role for impact finance both here and across Africa.

The traditional channels always give a very low return because of that there will always be an appetite for higher risk higher reward investments. If those investments can be coupled with a social conscience then that helps a great deal. But if you don’t have the right management, doesn’t matter what country you go in, you’re likely to be parted with your money, and that’s where the balance is.“

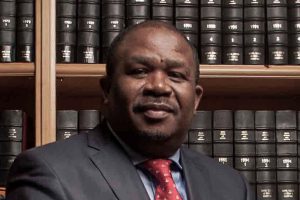

Terence Gregory, CEO of Escoponent Limited.

“We live and work in a historically underserved environment. Many projects fail here because there is very little risk capital available to start-ups.

Namibian start-ups have historically tried to get off the ground using loan capital. This model of funding sets them up for failure. When start-ups have loans to pay back, they feel under pressure to succeed immediately. This loan pressure messes up the start-ups cash flows and leads to failure.

Success to me would be having moved the needle on some of the more challenging social issues. This will be having created jobs for people and enabled them to self-actualise. My experiences working for a Canadian capital fund exposed me to what is possible if only underserved communities get capital funding.“

Jerome Kisting, Managing Director and Portfolio Manager of Baobab Capital. Namibia.

“There are many issues on the ground that means that capital is not necessarily reaching the most impactful business models and that the promised returns may not be realised. There appears to be a gap in understanding between foreign impact investors and local entrepreneurs that needs to be bridged if capital is to be allocated to locally-founded businesses with long-term growth potential.

“There are many issues on the ground that means that capital is not necessarily reaching the most impactful business models and that the promised returns may not be realised. There appears to be a gap in understanding between foreign impact investors and local entrepreneurs that needs to be bridged if capital is to be allocated to locally-founded businesses with long-term growth potential.

So what is going on? The vast majority of impact investment firms operating in Africa source funds from outside Africa and most make investment decisions outside Africa too. Recent evidence suggests that the biases and behaviour of foreign impact investors may not lead them to investing in the local entrepreneurs with the best chance of long-term financial success and social impact.”

Fiona Mungai, Managing Director of Endeavor, Kenya.

“The label of impact investing is interesting, particularly for emerging economies here in Africa. There is an inevitable impact of great magnitude by investing in base economy sectors and the emerging markets of Africa.

“The label of impact investing is interesting, particularly for emerging economies here in Africa. There is an inevitable impact of great magnitude by investing in base economy sectors and the emerging markets of Africa.

I embrace the label and it has been our label for the past 24 years to ensure that what we do, whether investment or advice, we do with an intent of bettering the overall environment.”

William Jimerson, Managing Director of Musa Capital. South Africa.

“We need to create a society that has independent individuals.

The only thing that will take Africa out of poverty and Africa out of the way it is now is investing in education, investing in entrepreneurship and in the development of the next generation.

The youth should be our focal point now, so we can produce a new generation of people that will be able to lead our nations with integrity and ethics. It is up to us now to create an informed generation with the right knowledge and wisdom.”

Sipho Mseleku, Managing Director of Sakhumnotho Group Holdings (Pty) Ltd. South Africa.

“Many of the markets in which we invest have high double-digit GDP growth. Most of the times, these markets tend to have higher inflation, weaker financial and governance institutions, and there is a challenge in accessing dollars from the banks.

If you can’t find the funds to build a cancer treatment unit, then it is even more difficult to put in place the institutions and find the funding to train human capital in order to operate the facilities.

The venture capital market in Africa is a necessity.

Investing in Africa needs a flexible approach, a good understanding of the capital structure, an adjustable time frame, and a good knowledge of product structure.“

Afsane Jetha, CEO of Alta Semper Capital. United Kingdom, Egypt & Nigeria.

“When we got IDF capital off the ground, we placed our primary focus on women entrepreneurs because we noticed that though efforts to facilitate the mainstreaming of black businesses were being made, black women were still being left out. This is despite a market study that had been done by the Department of Trade and Industry that showed that women made up the majority of self-employed people of small micro and medium-sized enterprises. We, therefore, made it our mission to focus on women-owned businesses.

At the start, we provided mostly debt instruments like loans because the market was not yet sophisticated enough for us to have a conversation about providing equity and shareholding. A lot of the businesses were also so small that it didn’t make sense for us to take part in ownership. We also had businesses that were just not scalable and could not be relied on to give decent returns. Things have changed over the last few years, though. As the market has matured and black people have begun leaving their jobs and starting businesses, the conversation around equity has become much easier to have.

We now provide a good balance between pure debt instruments as well as early-stage equity financing. We have also tried to be very responsive to the market over the years. As of now, we have been able to accelerate 44 businesses and have funded 24. We have also been able to fund both debt and equity of more than 180 businesses with the majority of them being women-owned. Our focus on women businesses received a big boost after we went into partnership with a Nigerian private equity firm also owned by a woman.“

Ms. Polo Leteka, Executive Director of IDF Capital. South Africa.

“We believe strongly in the power of business in creating wealth and fulfilling the needs of society. We also believe in its ability to address developmental challenges that are unique in African nations. The public sector may not have sufficient resources to address these issues, and that’s where the business community comes in. As investors, we see our role as being creators of wealth, as well as being people who satisfy market needs. We are currently focussing on the food and agriculture sector, which is primary in the regional economy. We also do extend our involvement in other areas as well.

“We believe strongly in the power of business in creating wealth and fulfilling the needs of society. We also believe in its ability to address developmental challenges that are unique in African nations. The public sector may not have sufficient resources to address these issues, and that’s where the business community comes in. As investors, we see our role as being creators of wealth, as well as being people who satisfy market needs. We are currently focussing on the food and agriculture sector, which is primary in the regional economy. We also do extend our involvement in other areas as well.

Effective partnership between the private and public sectors has to begin with a meeting of the minds to determine what the priorities should be. Private sectors are always grounded on environments created by public sectors; this stresses the need for a close relationship between the two sectors. Leaders on both sides must articulate the main points of focus be it infrastructure, or regulations. The amount of capital needed to make such sectors thrive cannot only come from a country’s tax base. The private sector must provide a huge chunk of that capital. Capital will only flow from the private sector if there is a predictability about the business environment, regulatory stability, political stability, and state policy. The Africa Free Trade Agreement is a welcome development for the strategic development of the continent. The business and financial sectors will play a huge role by providing thought leadership by referencing models that have worked elsewhere.“

Herman Marias, CEO of EXEO Capital, South Africa.